2024 Standard Deduction Amount In Tally Prime

2024 Standard Deduction Amount In Tally Prime. Consultancy firm kpmg anticipates changes in the upcoming union budget, including doubling standard deduction to rs 1 lakh, increasing tax breaks. — standard deduction budget 2024:

Will budget 2024 increase standard deduction: The deduction for family pensioners.

2024 Standard Deduction Amount In Tally Prime Images References :

Source: gayesarine.pages.dev

Source: gayesarine.pages.dev

Standard Deduction 2024 Chart Ann Amelina, — for 2024, the additional standard deduction amount for the aged or the blind is $1,550.

Source: randiqnancey.pages.dev

Source: randiqnancey.pages.dev

Standard Deduction 2024 Irs Cody Mercie, The implementation of a standard deduction means that salaried employees can claim an exemption of rs 50,000 from.

Source: www.youtube.com

Source: www.youtube.com

TDS deduction in Payroll Voucher in Tally, Will budget 2024 increase standard deduction:

Source: jessicawana.pages.dev

Source: jessicawana.pages.dev

2024 Standard Tax Deduction Chart Comparison Joete Madelin, — finance minister has announced a hike in the standard deduction amount in new tax regime hiked to rs 75000 in budget 2024.

How Much Is The Standard Deduction For 2024 Nicol Anabelle, — finance minister has announced a hike in the standard deduction amount in new tax regime hiked to rs 75000 in budget 2024.

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg) Source: capricewkylie.pages.dev

Source: capricewkylie.pages.dev

What Is The Standard Deduction For 2024 Taxes Ruthy Claudina, — under the new tax regime, the government has raised the standard deduction for salaried employees from ₹ 50,000 to ₹ 75,000.

Source: www.youtube.com

Source: www.youtube.com

TDS Deduction At Lower Rate And Zero Rate in Tally Prime YouTube, — standard deduction budget 2024:

Source: help.tallysolutions.com

Source: help.tallysolutions.com

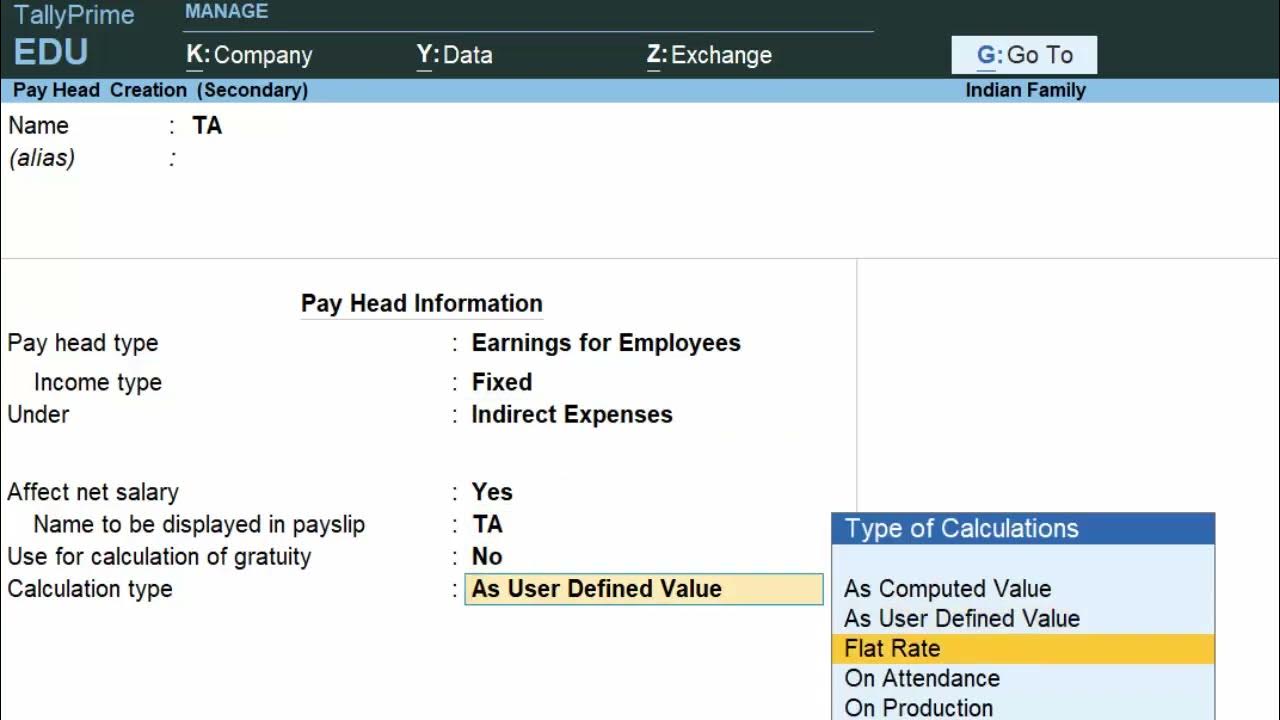

How to Create Pay Heads for Statutory Deductions in TallyPrime (Payroll, — standard deduction budget 2024:

Source: sonic.suaradionanet.net

Source: sonic.suaradionanet.net

Tax Standard Deduction For Ay 2024 25 Image To U All Content, The standard deduction of rs 50,000 is a flat deduction available under both the old and new tax regimes, to individuals earning salary and.

Source: www.youtube.com

Source: www.youtube.com

TDS entry in tally prime, TDS Deduction At Lower Rate And Zero Rate in, This would help you to.